“Anchors away”

Economist Feb 20th 2016

“As China’s Economic Picture Turns Uglier, Beijing Applies Airbrush”

EDWARD WONG and NEIL GOUGH FEB. 25, 2016

http://www.nytimes.com/2016/02/26/business/international/china-data-slowing-economy.html?_r=0

accessed FEB 25, 2016

l 人類進入21世紀壹拾年代。民主的日本和非民主的中國都在縮緊對媒體的管制。怎麼啦?是人類整體退步了嗎?還是媒體在國家人民整體利益下應該管訓?

l Mankind has entered the second decade of the 21th century. Yet, both the democratic Japan and the undemocratic China are tightening control of the media. What has happened? Is it that mankind has retrogressed? Or, under the total interest of a country and its people, media ought to be controlled?

Anchors away

FOR a decade, millions of Japanese have tuned in to watch Ichiro Furutachi, the salty presenter of a popular evening news show, TV Asahi’s “Hodo Station”. But next month Mr Furutachi will be gone. He is one of three heavyweight presenters leaving prime-time shows on relatively liberal channels. It is no coincidence that all are, by Japanese standards, robust critics of the government.

Last year another anchor, Shigetada Kishii, used his news slot on TBS, a rival channel, to question the legality of bills passed to expand the nation’s military role overseas. The questioning was nothing less than what most constitutional scholars were also doing—and in private senior officials themselves acknowledge the unconstitutionality of the legislation, even as they justify it on the ground that Japan is in a risky neighbourhood and needs better security. But Mr Kishii’s on-air fulminations prompted a group of conservatives to take out newspaper advertisements accusing him of violating broadcasters’ mandated impartiality. TBS now says he will quit. The company denies this has anything to do with the adverts, but few believe that.

The third case is at NHK, the country’s giant public-service broadcaster. It has yanked one of its more popular anchors off the air. Hiroko Kuniya has helmed an investigative programme, “Close-up Gendai”, for two decades. NHK has not said why she is leaving, but colleagues blame her departure on an interview last year with Yoshihide Suga, the government’s top spokesman and closest adviser to Shinzo Abe, the prime minister.

Mr Suga is known for running a tight ship and for demanding advance notice of questions from journalists. In the interview Ms Kuniya had the temerity to probe him on the possibility that the new security legislation might embroil Japan in other countries’ wars. By the standards of spittle-flecked clashes with politicians on British or American television, the encounter was tame. But Japanese television journalists rarely play hardball with politicians. Mr Suga’s handlers were incensed.

It all shows how little tolerance the government has for criticism, says Makoto Sataka, a commentator and colleague of Mr Kishii’s. He points out that one of Mr Abe’s first moves after he returned to power in 2012 was to appoint conservative allies to NHK’s board. Katsuto Momii, the broadcaster’s new president, wasted little time in asserting that NHK’s role was to reflect government policy. What is unprecedented today, says Shigeaki Koga, a former bureaucrat turned talking head, is the growing public intimidation of journalists. On February 9th the communications minister, Sanae Takaichi, threatened to close television stations that flouted rules on political impartiality. Ms Takaichi was responding to a question about the departure of the three anchors.

Political pressure on the press is not new. The mainstream media (the five main newspapers are affiliated with the principal private television stations) are rarely analytical or adversarial, being temperamentally and commercially inclined to reflect the establishment view. Indeed the chumminess is extreme. In January Mr Abe again dined with the country’s top media executives at the offices of the Yomiuri Shimbun, the world’s biggest-circulation newspaper. Nine years ago, when Mr Abe resigned from his first term as prime minister, the paper’s kingpin, Tsuneo Watanabe, brokered the appointment of his successor, Yasuo Fukuda. Mr Watanabe then attempted to forge a coalition between ruling party and opposition. Oh, but his paper forgot to alert readers to all these goings-on. The media today, says Michael Cucek of Temple University in Tokyo, has “no concept of conflict of interest.”

It has all contributed to an alarming slide since 2011 in Japan’s standing in world rankings of media freedom. Mr Koga expects a further fall this year. He ran afoul of the government during his stint as a caustic anti-Abe commentator on “Hodo Station”. On air last year he claimed that his contract was being terminated because of pressure from the prime minister’s office. His aim, Mr Koga insists, was to rally the media against government interference. Yet TV Asahi apologised and promised tighter controls over guests. Now Mr Furutachi is quitting too. The government is playing chicken with the media, Mr Furutachi says, and winning.

As China’s Economic Picture Turns Uglier, Beijing Applies Airbrush

BEIJING — This month, Chinese banking officials omitted currency data from closely watched economic reports.

Just weeks earlier, Chinese regulators fined a journalist $23,000 for reposting a message that said a big securities firm had told elite clients to sell stock.

Before that, officials pressed two companies to stop releasing early results from a survey of Chinese factories that often moved markets.

Chinese leaders are taking increasingly bold steps to stop rising pessimism about turbulent markets and the slowing of the country’s growth. As financial and economic troubles threaten to undermine confidence in the Communist Party, Beijing is tightening the flow of economic information and even criminalizing commentary that officials believe could hurt stocks or the currency.

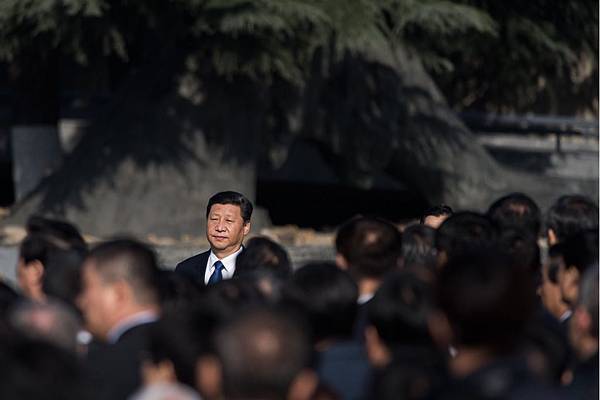

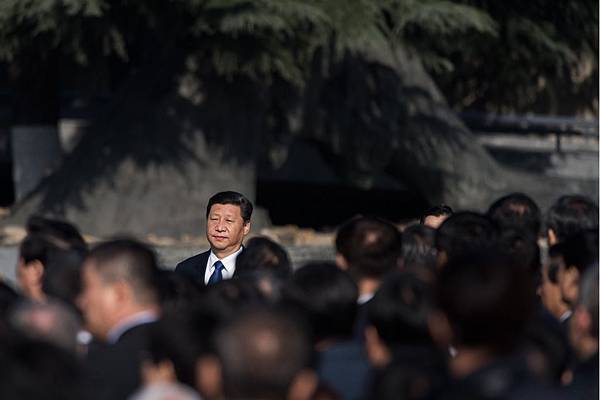

The effort to control the economic narrative plays into a wide-reaching strategy by President Xi Jinping to solidify support at a time when doubts are swirling about his ability to manage the tumult. The government moved to bolster confidence on Saturday by ousting its top securities regulator, who had been widely accused of contributing to the stock market turmoil. Mr. Xi is also putting pressure on the Chinese media to focus on positive news that reflects well on the party.

But the tightly scripted story makes it ever more difficult to get information needed to gauge the extent of the country’s slowdown, analysts say. “Data disappears when it becomes negative,” said Anne Stevenson-Yang, co-founder of J Capital Research, which analyzes the Chinese economy.

The party’s attitude has raised further questions among executives and economists over whether Chinese policy makers know how to manage a quasi-market economy, the second-largest economy in the world, after that of the United States.

Economists have long cast some doubt on Chinese official figures, which show a huge economy that somehow manages to avoid the peaks and valleys that other countries regularly report. In recent years, China made efforts to improve that data by releasing more information more frequently, among other measures. It also gave its financial media greater freedom, even as censors kept a tight leash on political discourse.

But the party now sees reports of economic turbulence as a potential threat. The same goes for data.

“Many economic indicators are on a downward trend in China, and economic data has become quite sensitive nowadays,” said Yuan Gangming, a researcher at Tsinghua University’s Center for China in the World Economy.

The restrictions illustrate the Chinese government’s competing priorities, said Leland R. Miller, president of China Beige Book International, which surveys Chinese companies. “The environment is getting tougher and tougher to operate in,” he said, though he added that his company had not been told to rein in its activities.

“We are going to continue to see crackdowns on people telling a different story than what Beijing wants to hear,” Mr. Miller said. “At the same time, Beijing appears to be conflicted on this issue, because it recognizes that without independent gauges, commercial relations and foreign direct investment will suffer, due to growing skepticism over official data.”

Last September, Markit Economics, a British company, and Caixin Media, based in Beijing, stopped publishing preliminary results from a monthly survey of purchasing managers at Chinese factories. The preliminary results, which came a few days before the two firms and the government separately released complete numbers, often affected markets. As a result, officials at China’s statistics bureau objected to the early release, according to people with knowledge of the official order.

A spokeswoman for Markit declined to comment, while Caixin representatives did not respond to a request for comment.

“It’s a very influential economic indicator, and it’s highly cited overseas,” said Mr. Yuan, the researcher at Tsinghua. “Given the international worry over the Chinese economy, I had a sense last August that the Caixin indicator wouldn’t really last long, because its publishing in mainland China had touched high-tension lines.”

In January data released last week, the Chinese central bank omitted or hid one key number and altered the parameters of another that gave insight into what the central and commercial banks were doing to prop up the country’s currency.

Both sets of numbers, which show commercial banks’ foreign exchange purchase positions, appeared last year in the central bank’s monthly announcements. The central bank, the People’s Bank of China, did not answer a request for comment.

China’s central bank and national statistics bureau “are constantly changing, redefining, introducing and excluding statistics, and I don’t think it is by accident,” said Christopher Balding, an associate professor at Peking University HSBC Business School.

The National Bureau of Statistics did not return requests seeking comment.

Ms. Stevenson-Yang, of J Capital Research, said she and her colleagues had seen growing discrepancies in official data in the last two years in a variety of sectors, including retail, shipping and steel production. She said a colleague had once called a Chinese cement factory to ask for production data, and a factory employee had thought the researcher was calling from a government-affiliated research association. The employee told the researcher that the factory had already changed its numbers twice and would rather not do it again, so the researcher could choose any number that fit.

“When you go around and meet state-owned industry people, everybody laughs at the national statistics, so I don’t know why foreigners believe them,” Ms. Stevenson-Yang said.

Capital Economics, a London research firm, said in a recent report that problems with China’s statistical system “go beyond those found in an emerging economy. The biggest is that the G.D.P. growth rate is politically sensitive, which makes it more likely to suffer manipulation.” The firm does its own growth-rate estimate for China’s gross domestic product, which it put at 4.3 percent last year.

China’s online monitors have intensified their policing of chatter about markets. “The People’s Bank has gone crazy,” read one recent post that was later deleted, referring to the central bank. Another deleted post said: “One mistake after another. All assets are gone.”

Last June, Liu Qintao, a journalist for a newspaper in Shandong Province, posted in an online forum a message he had seen about Dongguan Securities, a Chinese brokerage firm. The post said Dongguan Securities had warned “V.I.P. investors” about coming risks and had urged them to sell.

The next day, Dongguan Securities said none of its employees had issued the warning. Chinese stock markets began crashing two weeks later.

On Jan. 8, more than six months after he posted the message, officials fined Mr. Liu $23,000 on a charge of having spread fabricated information. Mr. Liu said in an interview that he was being made a scapegoat and was appealing the fine.

“I didn’t fabricate the message,” he said. “Why would I do that? Who would make up things like that? All I did was copy and paste it.”

The China Securities Regulatory Commission did not respond to a request for comment.

Jon R. Carnes, founder of Eos Funds, a firm best known for bets that Chinese stock prices will fall, said China is in the midst of a down cycle in a long-running ebb and flow of public information. In 2012, a researcher for the fund, Kun Huang, was put in prison for two years for gathering information that led Eos Funds to bet against a Chinese mining company.

Last summer, Mr. Carnes said, China started to make it more difficult to gain access to online information about companies. “In general, over time, the trend has been positive and improving, but since last summer, we did see another step backward,” he said.

“I’m optimistic and feel over all that the long-term trend is still improving,” he added. “But this is an unfortunate setback.”

北京——本月,中国的银行官员剔除了受到密切关注的经济报告中的货币数据。仅在几周前,一位新闻工作者因为转发了一条宣称某大证券公司告诉大客户卖出股票的消息,而被中国的监管机构罚款15万元人民币。

在此之前,政府强制要求两家公司停止发布一项中国工厂调查的初步结果——该调查通常会对市场产生不小的影响。

中国领导人正采取越来越大胆的措施,来抑制市场动荡和国家经济增长放缓所带来的不断上升的悲观情绪。由于金融和经济问题威胁到了人们对共产党的信心,北京正在收紧经济数据的流动,甚至将政府认为可能会伤害股票市场或货币的评论判定为犯法行为。

在外界纷纷质疑习近平主席处置混乱情况的能力时,控制经济评论的努力与他的一项具有广泛影响的策略相契合,目的是巩固对自己的支持。周六,政府免去了其证券监管机构最高管理者的职务以增强人们的信心,此人被广泛指责造成了股市的动荡。习近平也给中国媒体施加压力,让他们重点报导对共产党有利的正面消息。

但是分析人士表示,照本宣科的报道使得人们比以往任何时候都更难以获得衡量该国经济放缓程度所需的信息。“当数据变得不利时,它就会消失,”分析中国经济的美奇金投资咨询公司(J Capital Research)共同创始人杨思安(Anne Stevenson-Yang)说。

共产党的态度引发了企业高管和经济学家的进一步质疑:中国的决策者们是否知道如何在这个仅次于美国的世界第二大经济体,管理准市场化的经济。

经济学家们早就对中国的官方数据有所怀疑,这些数据显示,这个巨大的经济体总是能莫名其妙地避开其他国家在经济增长中经常会遇到的高峰和低谷。近年来,中国通过更频繁地发布更多信息,并采取其他措施,来试图改善这些数据。官方也向财经媒体赋予了更大的自由度,尽管审查机构仍然对政治话语保持着严格的控制。

但是,共产党现在把关于经济动荡的报导当成了潜在的威胁。对待数据的态度也是如此。

“很多经济指标都在下滑,很多经济数据现在变得很敏感,”清华大学中国与世界经济研究中心(Tsinghua University’s Center for China in the World Economy)的研究人员袁钢明(Yuan Gangming)说。

这些限制说明了中国政府在政策重点上左右为难,调研中国企业的中国褐皮书国际(China Beige Book International)总裁利兰·R·米勒(Leland R. Miller)说。他说,“经营环境变得越来越艰难。”不过他又补充道,他的公司还没有接到约束其营业活动的指令。

“我们还将会看到北京打压那些讲出了北京不愿意听的事的人,”米勒说。“与此同时,北京似乎在这个问题上也很矛盾,因为它认识到,如果没有独立的指标数据,商业关系和外国直接投资将受到影响,因为官方数据受到了越来越多的质疑。”

去年9月,英国公司Markit Economics和总部设在北京的财新传媒(Caixin Media),停止发布每月一度的采购经理人指数的初步结果。这项初步结果会在两家公司与政府分别发布完整数字前几天出炉,往往会对市场造成影响。据了解官方指令的人透露,中国统计局官员因此反对提前发布。

Markit的发言人拒绝对此发表评论,而财新的代表没有对记者的置评请求做出回应。

“这是个很重要的经济指标,国外很多都在用,”清华大学研究员袁钢明说。“国际上很多人都对中国经济有一种恐慌。去年8月时候我就感觉财新这个指数不会存在很久,它在大陆的发布触碰了高压线。”

1月,中国央行略去,或者说隐藏了一项关键数据,并修改了另一项数据的参数。后者能让外界了解央行和商业银行为支撑人民币而采取的措施。

去年,能显示商业银行外汇买入情况的两组数据均出现在了央行每月发布的报告中。作为中国央行的中国人民银行未回复置评请求。

北京大学汇丰商学院副教授克里斯托弗·鲍尔丁(Christopher Balding)称,中国央行和国家统计局“一直在不停地修改、重新定义、引入和去除统计数据,我认为这绝非偶然”。

中国国家统计局也未回复置评请求。

美奇金投资咨询公司的杨思安表示,她和同事发现,过去两年里,在包括零售、运输和钢铁生产在内的各行业,官方数据中的差异越来越大。她说,一个同事曾打电话给中国的一家水泥厂询问生产数据,那家工厂的员工以为这位研究人员是从隶属于政府的研究机构打来的,便说工厂的数据已经改过两遍了,不想再改了,因此让研究人员任意选一个合适的数字。

“出去碰到国企的人,个个都笑话官方的统计数据,所以我不知道外国人为什么相信,”杨思安说。

伦敦研究公司凯投宏观(Capital Economics)在最近的一份报告中称,中国统计制度的问题“不仅限于在新兴经济体发现的那些问题。其最大的问题是GDP增速在政治上很敏感,这让它更有可能受到篡改”。该公司自己会对中国的国内生产总值增长速度进行估算,其估计的中国去年的增速为4.3%。

中国的网络管理员加强了对谈论市场的言论的监督。“央行蛇精病附身,”最近的一篇帖子谈及央行时写道。随后,这篇帖子被删除。另一篇被删的帖子说:“反复试错,资产垮了。”

去年6月,供职于山东一家报纸的记者刘钦涛在一个网络论坛里发布了自己看到的一则和证券公司东莞证券有关的消息。帖子里说东莞证券警告“VIP”投资者注意即将到来的风险,并建议清仓。

第二天,东莞证券称员工中无人发布预警。两周后,中国股市开始崩盘。

1月8日,在距发帖已过去六个多月后,刘钦涛被官员以传播虚假证券信息的罪名罚款15万元。刘钦涛在接受采访时表示自己成了替罪羊,并称将对罚款的决定进行上诉。

“我没有编造消息,”他说。“我编那个干嘛?谁会做出这样的事来?我是从微信里粘贴复制过去的。”

中国证券监督管理委员会同样未回复置评请求。

伊奥斯基金(Eos Funds)创始人乔恩·R·卡内斯(Jon R. Carnes)称,中国正处在一个漫长的公共信息起伏循环的下跌周期中。该公司以看空中国股市而闻名。2012年,该基金会的研究员黄崑被判两年有期徒刑,原因是他为该基金搜集信息,并促使其做空中国一家矿产公司。

卡内斯称,去年夏天,中国开始增加在网上获取公司信息的难度。“总的来说,随着时间的推移,趋势是积极的,在不断改善,但从去年夏天开始,我们的确发现又发生了倒退,”他说。

“我持乐观态度,总体上觉得长期趋势还是在不断改善,”他接着说。“不过这个倒退令人遗憾。”

黄安伟(Edward Wong)是《纽约时报》北京分社社长。

黄安伟自北京、Neil Gough自香港报道。Mia Li、Owen Guo自北京对本文有研究贡献。

留言列表

留言列表