台灣: 亂世福地

accessed March 18, 2021

台灣:亂世福地

Taiwan: Blessed Land in a Chaotic World

同樣標題,遲到一年。

Same Topic, One Year Late.

█ 2020年3月26日 林中斌 “台灣:亂世福地” 聯合報 A13

March 26, 2020 Chong-Pin Lin, “Taiwan: A Blessed Land in a chaotic World” United Daily (Taipei) A13

https://www.facebook.com/photo?fbid=3079612998736762&set=pcb.3079613622070033

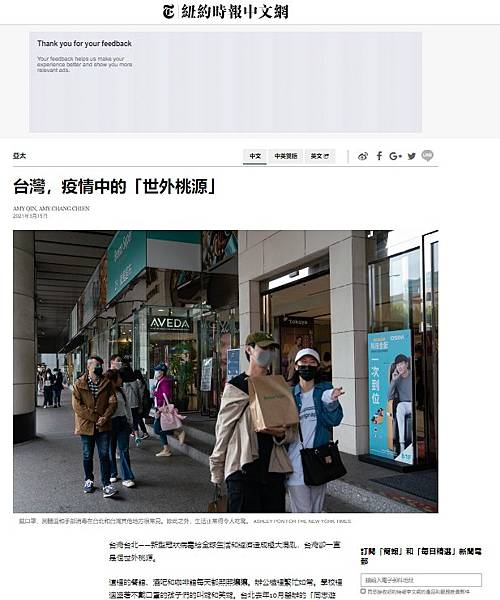

█ 2021年3月15日 “台灣,疫情中的「世外桃源」” 紐約時報 (中文)

March 13, 2021 Amy Qin and Amy Chang Chien “Covid? What Covid? Taiwan Thrives as a Bubble of Normality.” New York Times

˙https://www.nytimes.com/2021/03/13/world/asia/taiwan-covid.html

˙https://cn.nytimes.com/asia-pacific/20210315/taiwan-covid/zh-hant/?_ga=2.231819167.1823011193.1615939821-1666827234.161593982

台灣,疫情中的「世外桃源」

Amy Qin, Amy Chang Chien

2021年3月15日

https://cn.nytimes.com/asia-pacific/20210315/taiwan-covid/zh-hant/?_ga=2.231819167.1823011193.1615939821-1666827234.1615939821

下載 20210318

戴口罩、測體溫和手部消毒在台北和台灣其他地方很常見。除此之外,生活正常得令人吃驚。 ASHLEY PON FOR THE NEW YORK TIMES

台灣台北——新型冠狀病毒給全球生活和經濟造成極大混亂,台灣卻一直是個世外桃源。

這裡的餐館、酒吧和咖啡館每天都熙熙攘攘。辦公樓裡繁忙如常。學校裡迴盪著不戴口罩的孩子們的叫聲和笑聲。台北去年10月舉辦的「同志遊行」吸引了大約13萬人走上街頭。遊行隊伍中彩虹口罩隨處可見,但沒有多少人保持社交距離。

這個人口2400萬的自治島嶼,迄今只有10人死於新冠病毒疾病,累計不到1000例感染病例。台灣利用其遏制大流行病的成功把自己作為某種緊俏東西——不用擔心新冠病毒的生活——推銷給世界。獲准進入台灣的人相對有限,他們成群地來到這裡,幫助推動了台灣的經濟繁榮。

「台灣有一段時間有一點空空蕩蕩的。很多人可能就在國外定居了,久久回來一次,」台中的米其林一星餐廳鹽之華(Fleur de Sel)主廚黎俞君說。她表示,從去年秋天起,需要提前幾個月預定鹽之華的餐位。「現在有一些久久回來一次的客人搬回來了。」

這些因新冠病毒回來的人主要是僑居海外的台灣人和有雙重國籍的人,其中包括商人、學生、退休者,以及像餐館老闆兼台灣裔美國作家黃頤銘(Eddie Huang)這樣的知名人士。據移民署的數據,2020年進入台灣的台灣人比離開的台灣人多出約27萬人,大約是上年凈流入人數的四倍。

上週五晚,台北市中心一家擁擠的酒吧。 ASHLEY PON FOR THE NEW YORK TIMES

自去年春天以來,台灣已對大部分外國旅行者關閉了邊境,但允許持有「就業金卡」的高技能非台灣籍工作人員入境。疫情期間,政府一直在大力推廣「就業金卡」計劃。自去年1月31日以來,金卡頒發量超過了1600張,是2019年的四倍多。

人員的湧入幫助台灣成為去年經濟增長最快的地方之一——實際上,台灣是為數不多的經濟出現增長的地方。新冠疫情開始時,台灣經濟曾短暫放緩,但第四季度的經濟與2019年同期相比增長了5%以上。政府預期的2021年經濟增長率為4.6%,這將是七年來最快的增速。

訂閱「簡報」和「每日精選」新聞電郵

同意接收紐約時報中文網的產品和服務推廣郵件

查看往期電郵 隱私權聲明

42歲的台灣裔美國企業家陳士駿(Steve Chen)是YouTube的聯合創始人,他是第一個申請就業金卡的人。2019年,他與妻子和兩個孩子從舊金山搬回了台灣。後來,新冠疫情暴發後,他在矽谷的許多朋友,尤其是那些台灣裔的朋友,也開始返回,出現了某種逆向人才流動。

陳士駿和其他同事,比如推趣(Twitch)的創始人之一林士斌(Kevin Lin)和遊戲《吉他英雄》的聯合製作人黃中凱,把以前在舊金山輪渡大廈咖啡館的聚會改為在台北的羽毛球賽和撲克之夜。台灣領導人說,國外人才的注入為其科技產業注入了活力。台灣一直以製造業實力而非創業文化聞名。

「曾在矽谷的整個鏈條——願意承擔風險的企業家,願意在早期給你開支票的投資者——所有這些人實際上已經回來了,現在都在台灣,」陳士駿坐在台北辦公室的沙發上說,這裡位於政府支持的一個聯合辦公空間裡。

「我覺得這是一個科技黃金時代,」他說,「政府開始意識到,他們應該現在就好好利用這個時代。」

2019年,YouTube聯合創始人陳士駿從舊金山搬回了台灣。自從新冠病毒疫情暴發以來,他在矽谷的朋友們已經加入到他的行列中來。 ASHLEY PON FOR THE NEW YORK TIMES

返台人數激增,給這裡的短期租房市場造成了壓力。據一位房地產經理估計,2020年想租公寓的雙重國籍者或海外台灣人的數量已高達近年年份的兩倍。

並不是台灣所有的產業都很繁榮。那些依賴強勁國際旅行的行業,如航空公司、酒店和旅遊公司,已受到沉重打擊。但台灣的出口已連續八個月增長,這主要是由於對台灣最重要的產品半導體晶片的需求激增,推動了電子產品發貨量。

境內旅遊業也在蓬勃發展。習慣搭乘短途航班到日本或東南亞旅行的台灣人,現在開始探索自己的家園。遊客已使日月潭和阿里山等觀光勝地應接不暇,台中郊外至少一家高檔酒店的房間已經預訂到了7月份。

蘭嶼是台灣東海岸一個珊瑚環繞的小島。那裡的遊客去年夏天如此之多,以至於酒店經營者們發起了一項活動,鼓勵遊客在離島時隨身帶走一公斤垃圾。

大流行病時代的某些東西已深入到台灣的生活中。查體溫、進行手部消毒很常見,許多公共場所要求戴口罩(但學校不要求)。

但在大多數情況下,新冠病毒已是人們眼不見、心不想的東西,這是因為台灣對接觸者進行嚴格追蹤、對入境者進行嚴格隔離。

一些從海外回來的人,比如35歲的羅賓·魏(Robin Wei),正在擔心他們最終要離開的問題。

「我們只是覺得很幸運,當然也有點內疚,」魏先生說。他是加州灣區一家科技公司的產品經理,去年5月帶著妻子和年幼的兒子回到了台北。「我們覺得,我們是這場大流行病的受益者。」

台北去年10月舉辦的「同志遊行」估計有約13萬人參加。 RITCHIE B. TONGO/EPA, VIA SHUTTERSTOCK

對許多人來說,回來意味著與台灣重新建立聯繫的機會。

在澳洲獲得計算機科學碩士學位後,25歲的台灣人約書亞·楊(Joshua Yang)去年10月決定回來,他擁有中華民國和澳洲雙重國籍。他說,澳洲的就業市場前景不佳,所以他抓住這個機會回來服兵役,台灣所有36歲以下的男性都必須服兵役。

楊先生並不是唯一有這種想法的人。他說,去年12月自己開始接受基本訓練時,他在新兵營裡看到了許多從海外歸來、有雙重國籍的人,包括一個美國籍、一個德國籍、一個菲律賓籍,還有一個在加州留學的海外台灣人。

在完成了兩週半的軍訓後,楊先生已獲許用在台灣南部一個偏遠小鎮的原住民歷史博物館當志願者的方式,來完成自己的服役。

「這是我一直想做的事情,但如果不是發生了大流行病,我不知道我是否會有這個機會,」楊先生說。「我能夠通過一個不同的視角、以一個不同的方式來了解我的家鄉,從台灣原住居民的角度,他們在歷史上是這片土地的擁有者。」

在上個月的台北國際動漫節上,人們用保持社交距離的方式排隊。 SAM YEH/AGENCE FRANCE-PRESSE — GETTY IMAGES

許多人想知道,台灣作為新冠病毒疾病面前的異類地位還能持續多久,尤其是在疫苗正在世界其他地方大量接種的情況下。到目前為止,台灣官員們在採購和分配疫苗上進展緩慢,部分原因是這裡對疫苗的需求很低。政府只是在本月才宣布已收到了第一批疫苗,將分配給醫務工作者。

一些人,比如72歲的孫泰玲(音),已經在制定離開這個「泡泡」的計劃。

今年1月,孫女士和丈夫在台灣親友的敦促下,從加州回到了她長大的高雄。親友擔心她住在奧蘭治縣不安全,那裡的新冠病毒感染病例一直在上升。

經過了兩週隔離後,孫女士出來時看到的台灣與以前回來時看到和感覺到的沒什麼不同,除了戴口罩之外。從那以後,她一直充分利用回來後的時間,做了一系列常規體檢。自疫情開始以來,許多美國人已經推遲了這些體檢。

但是,一個沒有病毒的天堂並不能讓人免患所有的疾病。孫女士說,她已經開始想家了。她很想見自己的五個孩子,呼吸郊外清新的空氣。她還說,她想要接種新冠病毒疫苗。

「能來這裡很不錯,」孫女士說。「但現在是回家的時候了。」

Amy Qin是《紐約時報》國際記者,負責報導中國文化、政治和社會之間的交匯。歡迎在Twitter上關注她:@amyyqin。

Amy Chang Chien在台灣為《紐約時報》報導中國大陸和台灣新聞。歡迎在Twitter上關注她 @amy_changchien。

翻譯:紐約時報中文網